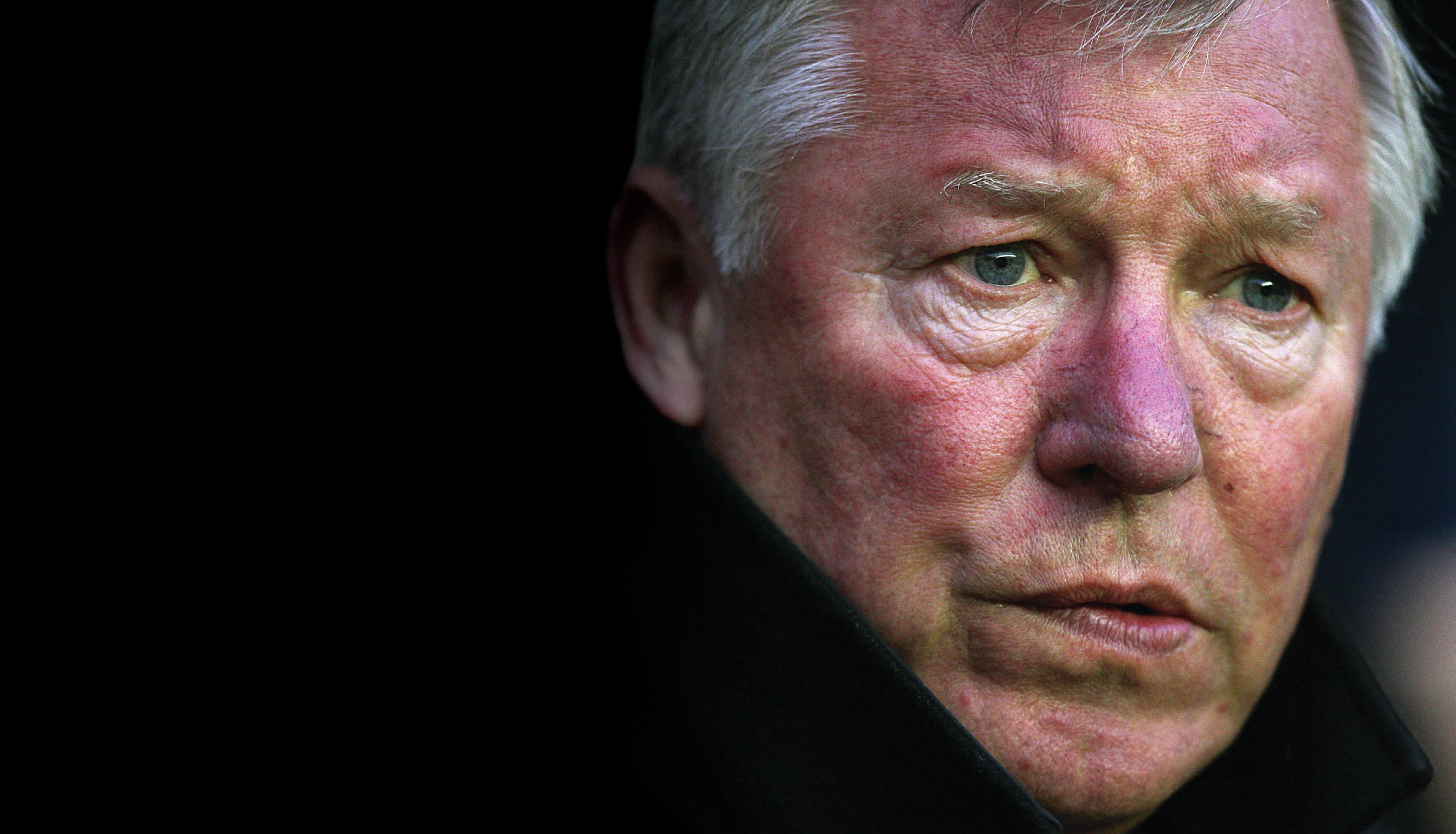

In May 2005, American businessman Malcolm Glazer completed his takeover of Manchester United by purchasing £800 m worth of shares in the football club. The takeover is an excellent example of a levered takeover: the majority of the money needed by Glazer to buy the shares was borrowed. As the new owner of Manchester United, Glazer took the club off the stock market, converting the business from a public limited company to a private limited company. The loans taken out by Glazer to finance his takeover were then transferred over to Manchester United’s balance sheet. Many Manchester United supporters were outraged. For many years the club had been virtually debt free. However, due to Glazer’s leveraged takeover, the club was now saddled with huge debts that would need to be serviced for many years to come. Manchester United’s gearing ratio had soared.

Gearing is an accounting ratio that measures the degree to which a firm is dependent upon borrowed money.

Your organisation does not have access to this article.

Sign up today to give your students the edge they need to achieve their best grades with subject expertise

Subscribe