The tax paid by incorporated businesses in the UK is a topic that attracts substantial media coverage and interest from politicians. We often hear stories about the (lack of) tax paid by large multinational companies, such as Amazon or Google, but there are around 4 million incorporated businesses in the UK. What’s the bigger picture here for the tax they pay? Who is affected by corporation tax? And what does economics have to say about its role in the tax system?

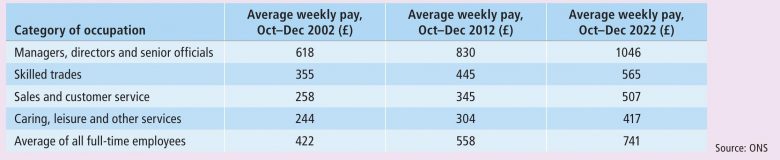

Corporation tax (CT) is a direct tax typically levied on the profits of an incorporated company — that is, sales minus any allowable costs, such as wages, capital investment and interest payments. The current UK rate is 19%, which is comparatively low for a large, developed country. In terms of tax revenue, it is the fourth most important tax instrument in the UK, with forecasts for 2018 indicating that it would bring £55 billion into the public coffers, or roughly 7% of total tax revenues.

Your organisation does not have access to this article.

Sign up today to give your students the edge they need to achieve their best grades with subject expertise

Subscribe