For many companies, the recent recession meant going to hell and back. Some, though, didn’t come back. What then were the survival prospects for a 40-year-old producer of not-very-fashionable, expensive handbags? Bags costing between £500–£1,500 each?

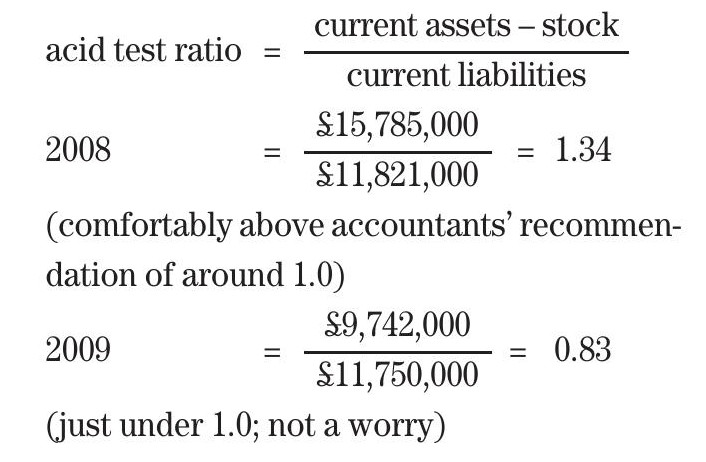

In the 3 years leading up to the 2008/09 recession, Mulberry had been going nowhere (see Table 1), even though this was a boom time for luxury products. The collapse in consumer confidence in autumn 2008 caused immediate and dramatic effects. Although Mulberry’s factory in Somerset is its flagship, 70% of its bags (the more labour-intensive, fiddly ones) are made in China, Spain and Turkey. This forces the company to place orders for the autumn/pre-Christmas season early in the year. Therefore, when demand slumped in October–December 2008, supplies kept coming. The company’s stocks (inventories) doubled between March 2008 and March 2009. The effect of this on the balance sheet can be seen in Table 2.

Your organisation does not have access to this article.

Sign up today to give your students the edge they need to achieve their best grades with subject expertise

Subscribe