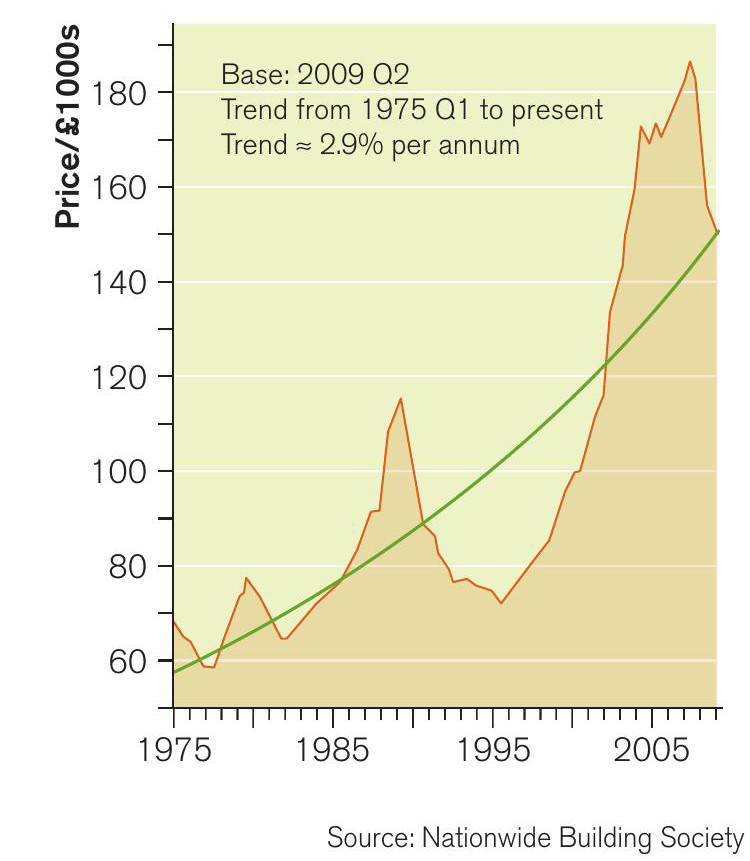

Figure 1 Real house prices

For decades, most people have aspired to home ownership, usually financed by a mortgage from a bank or building society. Owning your own home gives you the practical advantage of allowing you to change the property according to your own preferences and it is also an asset that can be sold (usually at more than the purchase price). Owner-occupation in the UK has always been seen as income elastic — as their income rises, people normally buy rather than rent a home and they purchase the best house that their income will allow. The mortgage size has always been linked to a multiple of the buyers’ salaries.

As incomes rose in the postwar years, home ownership grew and this increase was Source: Nation accelerated by the sale of council houses to tenants in the 1980s, as well the increased availability of mortgages from a variety of sources. Home ownership superseded renting as the most popular form of tenure in 1958, with the number of people renting declining to a low in 1989. Renting was largely seen as an option for those on low incomes (an inferior good), although its popularity has always remained strong with university students and those with jobs requiring extensive labour mobility. By the start of the twenty-first century, 70% of UK homes belonged to owner-occupiers.

Your organisation does not have access to this article.

Sign up today to give your students the edge they need to achieve their best grades with subject expertise

Subscribe